Was Sharemax illegal, or did the Reserve Bank screw up?

Here is a very interesting article from Moneyweb’s Ryk van Niekerk

We like particularly, and fully agree with;

“…. a massive indictment of South African regulators.”

- Link:

Here is a very interesting article from Moneyweb’s Ryk van Niekerk

We like particularly, and fully agree with;

“…. a massive indictment of South African regulators.”

Hier is ‘n baie interesante artikel deur Ryk van Niekerk

Ons hou veral van, en stem volkome saam met:

“…. a massive indictment of South African regulators.”

(Artikel slegs in Engels beskikbaar)

Skakel:

SLEGS AANDEELHOUERS. SLEGS AANDEELHOUERS WORD NA DIE AJV GENOOI – DIT IS GEWONE MAATSKAPPYPRAKTYK

SKULDBRIEFHOUERS IS SLEGS KREDITEURE SO KAN NIE DIE AJV BYWOON NIE EN KAN DUS NIE ‘N VOLMAG/PROXY GEE NIE

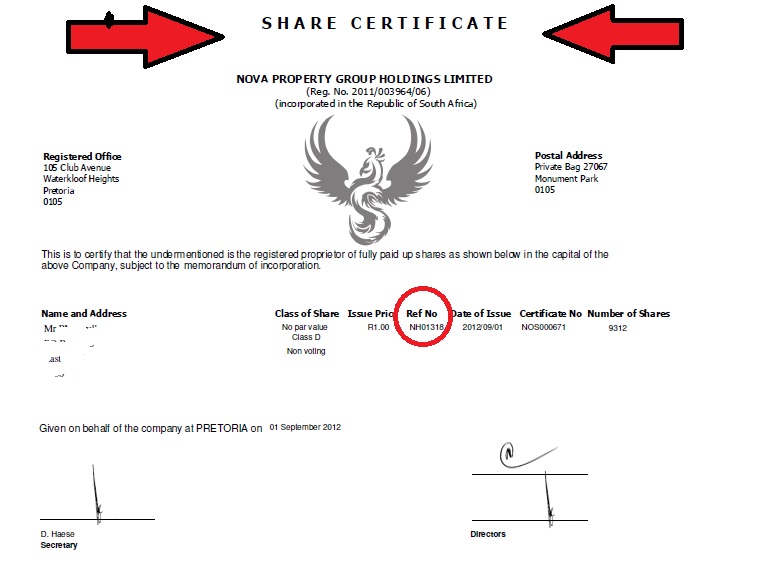

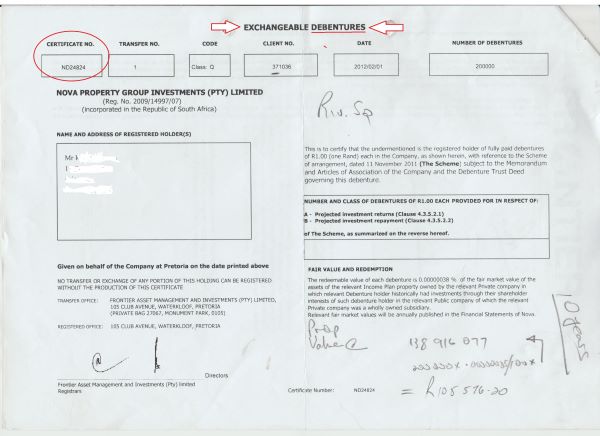

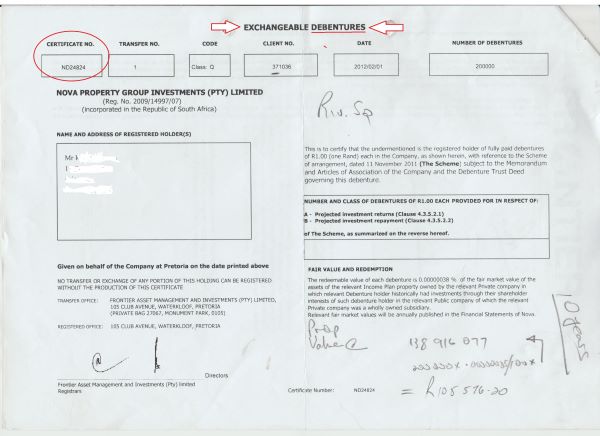

As u nie seker is watter van die twee u is nie, KYK NA U 2012-SERTIFIKATE

(Nie jou Sharemax-sertifikate nie – dit is nie meer van toepassing of geldig nie)

Sien die meegaande foto’s van beide Aandeel- en Skuldbriefsertifikate en word dienooreenkomstig gelei

Doen asseblief ‘n poging om te verstaan wie jy is en hoef dus nie vir ons e-posSte stuur om te vra en/of om jou volmag/proxy aan te bied wanneer jy Skuldbriefhouer is nie

Baie Dankie

WHO CAN GIVE A PROXY FOR THE NOVA AGM?

ONLY SHAREHOLDERS. ONLY SHAREHOLDERS ARE INVITED TO THE AGM – THIS IS NORMAL COMPANY PRACTICE

DEBENTURE HOLDERS ARE ONLY CREDITOR SO DO NOT GET TO ATTEND THE AGM AND SO CAN’T GIVE A PROXY

If you are not sure which of the two you are, CHECK YOUR 2012 CERTIFICATES

(Not your Sharemax certificates – they are no longer applicable or valid)

See the accompanying pictures of both Share and Debenture certificates and be guided accordingly

Please make an effort to understand which you are and thus not need to email us to ask and/or to offer your proxy when you are Debenture Holder

Thank you very much

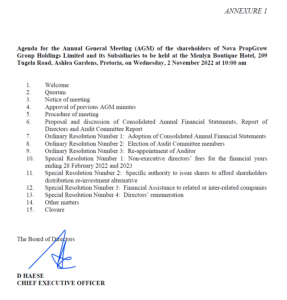

Below link and other included documents relate to the Nova Property AGM to be held on 2 November

SHAREHOLDERS:

* You will have received an email from Elma Champion at Frontier Accounting and Secretarial Services, the company that does Nova’s administration – admin@frontieram.co.za , inviting you to the AGM and providing the documentation posted herewith * We encourage you to attend. This AGM has, potentially, an impact on you down the line (If you can’t attend, we would like to have your proxy – see bottom of this message)

Likewise, DEBENTURE HOLDERS, take note as well. There is a potential impact on the future status of your debentures

And, potential impact on any possibility of getting your money back

The major item on the agenda is Special Resolution 2:

Specific authority to issue shares to afford shareholders distribution re-investment alternatives

To pass the following resolution as a special resolution:

Resolve that, subject to the provisions of the Companies Act 71 of 2008, as amended and relevant JSE Listings Requirements if applicable, the Board be and it is hereby authorized by way of a specific, standing authority to issue ordinary shares in the company as and when it deems appropriate, for the purpose of affording shareholders opportunities from time to time to elect to re-invest any distribution received by them in new ordinary shares of the company.

Reason for and effect of this special resolution: To authorize the Board to issue ordinary shares in the company for purposes of affording shareholders opportunities to elect to re-invest any distribution received by them in new ordinary shares in the company. In certain circumstances, such shareholders may also be directors, or prescribed officers, or inter-related parties to the company.

If you decided back around 2011 to become a Nova Property Shareholder (as opposed to election to be a Debenture Holder) you will have received your share certificates from Nova. These replaced the shares that you had in the Sharemax properties in which you originally invested

What does this mean?

We’re working on it and Herman Lombaard has been in discussion with various parties/entities addressing the Sharemax/Nova debacle

Questions that arise:

* Why the reference in the resolution text to “relevant JSE Listings Requirements if applicable”

* Are they or are they not applicable”

* If they are. Why?

* If they are, why is the detail/intention behind that not being imparted?

* Is Nova going to try and list on the JSE again?

* Will this lead to another attempt to get Debenture Holders to convert their “Creditor asset” to shares

* Which shareholders are referred to?

* The Sharemax investors who opted to become Nova shareholder back in 2011 hold Class D shares with no voting power.

* The “insider” shareholders – the Directors and those who have benefited from their connection with Nova, hold Class A and/or Class B shares. Both of these carry voting rights

* Has Nova ever made a distribution? – which we interpret as being a dividend payment to shareholders

* As far as we know, not once to the Class D shareholders

* And to the Class A & B shareholders? We expect that this may well have occurred (being insiders, after all)

* Nova is going to start making distributions?

* To which class(es) of shareholder

* Do Nova have the funds to do this (they are generally considered to be insolvent – which is also the view of CIPC)?

* If a shareholder elects to take shares instead of a distribution, which class of shares will be issued and will they have voting rights?

* Will there be a distinction between existing shares held by a Class D shareholder and the shares to be issued to such shareholder in exchange for a declared distribution/dividend (assuming that Class D shareholders are going to be eligible for participation in the proposed new arrangement?) But, has anyone any faith in Nova shares – apart from the insiders, of course?

* Will an approved resolution have any impact, whether immediate or in the future, involving the debentures and affecting the Debenture Holders? If yes, why are the Debenture Holders not being consulted ahead of the AGM and the vote

We have raised these questions with Corrie van Rooyen , the Nova Information Officer, and hope to have his response giving answers and clarity ahead of 2 November

BUT …what’s really going on behind this resolution? What is it aimed at achieving?

The consensus amongst the persons/entities with whom we interact, is that this is the opening move by Nova to escape the difficulty that it is in following the CIPC investigation (which is ongoing). See our posts on 30 August in the website and Facebook page

One outcome of the investigation is that Nova have been prohibited from selling any further assets – meaning the remaining nine properties that were in the original Sharemax portfolio – the rest having been sold off

CIPC is also holding Nova accountable for failure to repay the debenture Holders by 20 January of this year (10 years after the date of the Schemes of Arrangement – SoA – and the repayment schedule contained in same). Nova dispute that the SoA required repayment by that date, but nonetheless the resolution in question is being seen as the first step in Nova’s attempt to shift the goalposts by ultimately (but quite quickly) removing the Debentures as a Creditor item in the company balance sheet

If the books show there is no indebtedness to the Debenture Holders/Creditors, the major problem with CIPC goes away and it seems that the November 2 AGM has been orchestrated to bring in a Yes vote on the resolution ahead of the forthcoming tribunal hearing set up by CIPC (date not yet known)

Nova (actually, Connie Myburgh, who is Nova – the other insiders are only puppets) did the same thing back in January after the meetings to approve the appointment of J-P Tromp as the Debenture Deed Trustee. As soon as the rigged vote had delivered approval of Tromp’s appointment, Myburgh had Tromp approve an extension of the Debenture repayment date (without any reference to or the permission of, the Debenture Holders) and rushed that approval in to CIPC so that the failure to repay by 20 January was (ostensibly) no longer an issue. And, Tromp acknowledged his approval action but has not explained why and why he did not, or Nova did not, formally inform the Debenture Holders

Set up by CIPC

A WARNING TO BOTH SHAREHOLDERS AND DEBENTURE HOLDERS

It’s likely, but not in the immediate future, that Nova will, if the resolution is approved by the voting shareholders, come out with a proposal or offer, regarding options available in the event of a distribution (dividend?)

DO NOT AGREE TO ANYTHING THAT THEY PROPOSE

DO NOT AGREE TO, OR IN FAVOR OF, ANYTHING NOVA PRESENTS NOR ANYTHING FROM/BY MYBURGH AS THE SO-CALLED BUSINESS RESCUE PRACTITIONER NOR TO ANY ACTION OR PLAN AS PRESENTED BY JP TRUMP, THE DENVBENTURE TRUST TRUSTEE

ANYTHING THAT NOVA OFFERS WILL NOT BE IN YOUR BEST INTERESTS BUT ONLY TO SERVE THEMSELVES – PRIIMARILY TO GET CIPC OFF THEIR BACKS SO THAT THEY CAN CONTINUE TO OPERFATE AND QUITE LIKELY, CONTINUE TO SELL OFF THE REMAINING PROPERTIES UNTIL THERE ARE NO ASSETS LEFT ON THE BOOKS

WAIT FOR CLARITY AND REASONED OPINIONS AS TO WHAT YOUR BEST COURSE OF ACTION WILL BE

Lastly, SHAREHOLDERS, if you would like us to have your proxy, please email us at info@ndcag.co.za indicating your willingness to give it and we’ll communicate with you accordingly

Link to the Notice for Annual General Meeting:

NOTICE FOR ANNUAL GENERAL MEETING to be held 2 Nov 2022 for year end Feb 2021