Rapport artikel Sondag 14de/Article in Rapport, Sunday 14th

Indien dit die geval is, besoek asseblief ons Facebook-blad: Sharemax Investors/Nova Debenture Creditors

waar hierdie artikel ook geplaas is

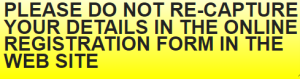

We apologise for possible image readability shortcomings

Should this be the case, please visit our Facebook page: Sharemax Investors/Nova Debenture Creditors

where this article has also been posted